With great pleasure, we will explore the intriguing topic related to 2025-2026 Tax Brackets: A Comprehensive Overview. Let’s weave interesting information and offer fresh perspectives to the readers.

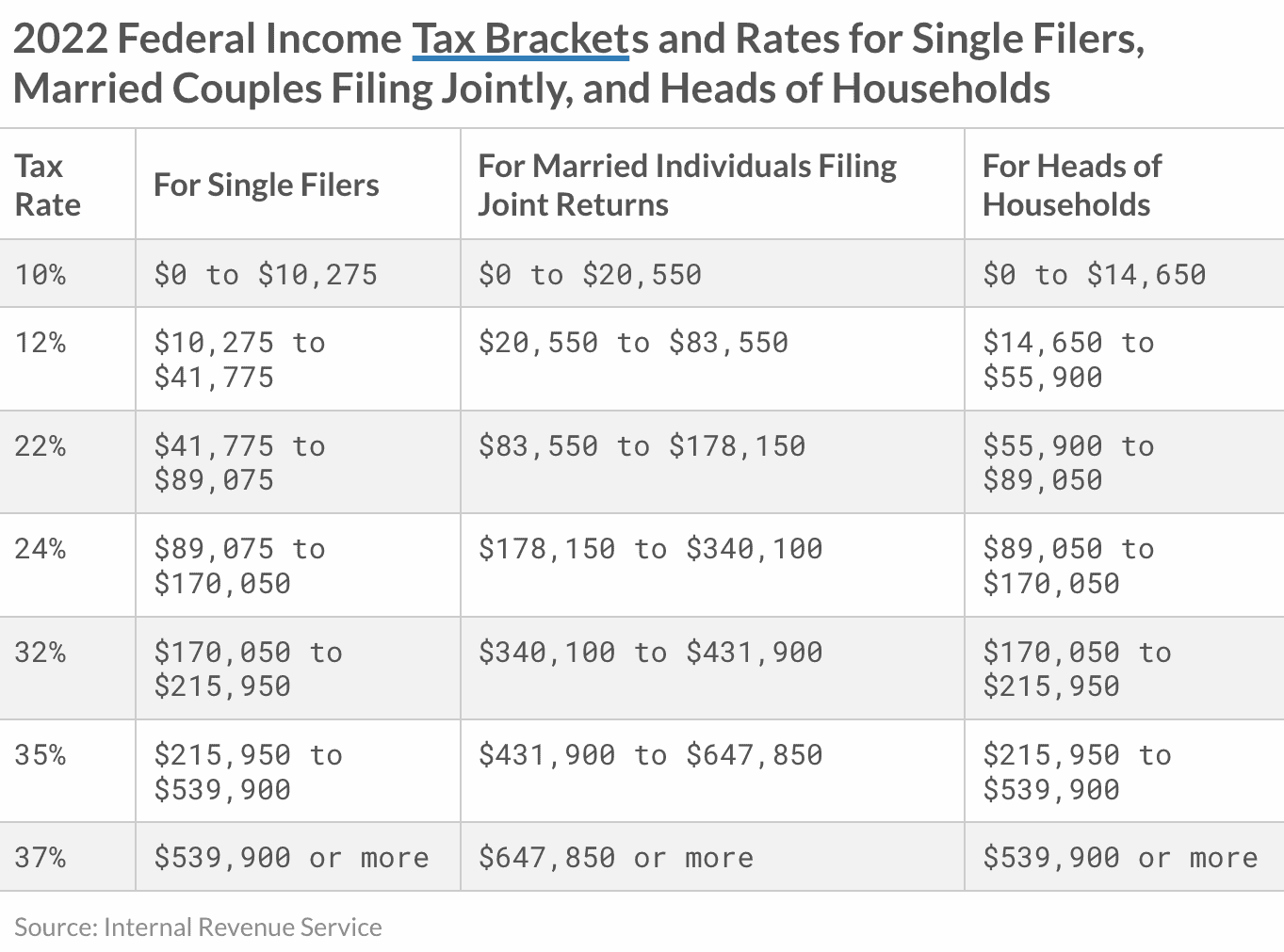

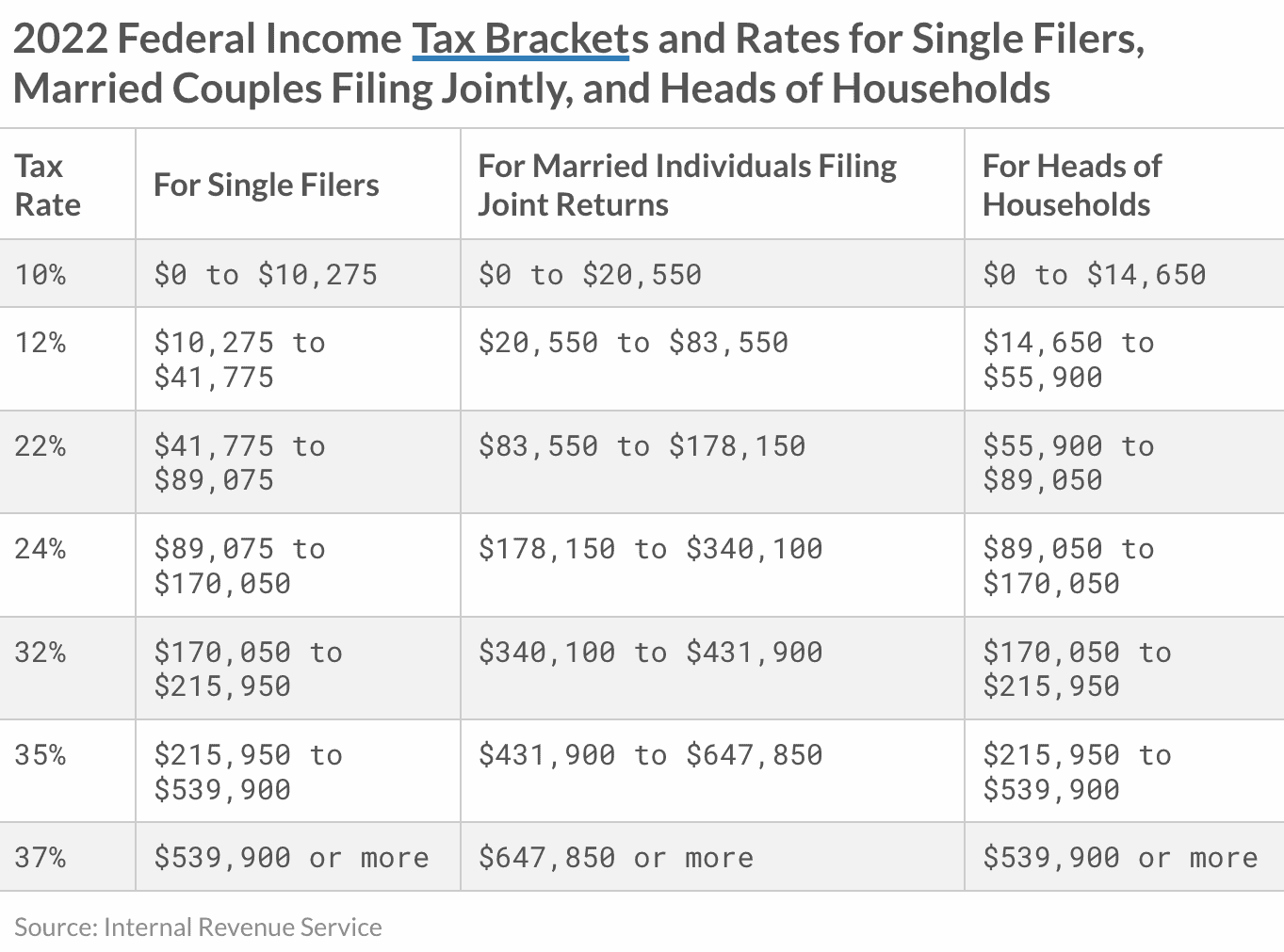

Tax brackets are essential in determining the amount of income tax individuals and businesses owe. They establish the progressive tax system, where higher earners pay a larger percentage of their income in taxes. The tax brackets for 2025 and 2026 have been released by the Internal Revenue Service (IRS), and they reflect several changes compared to previous years. This article provides a comprehensive overview of the 2025-2026 tax brackets, including the income ranges, applicable tax rates, and the implications for taxpayers.

The standard deduction is a specific amount that taxpayers can deduct from their taxable income before calculating their tax liability. The standard deductions for 2025 and 2026 are:

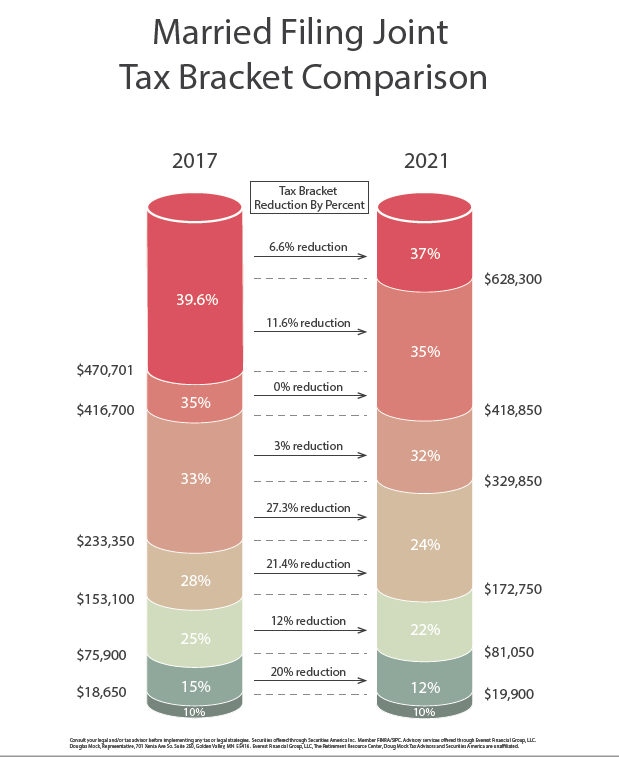

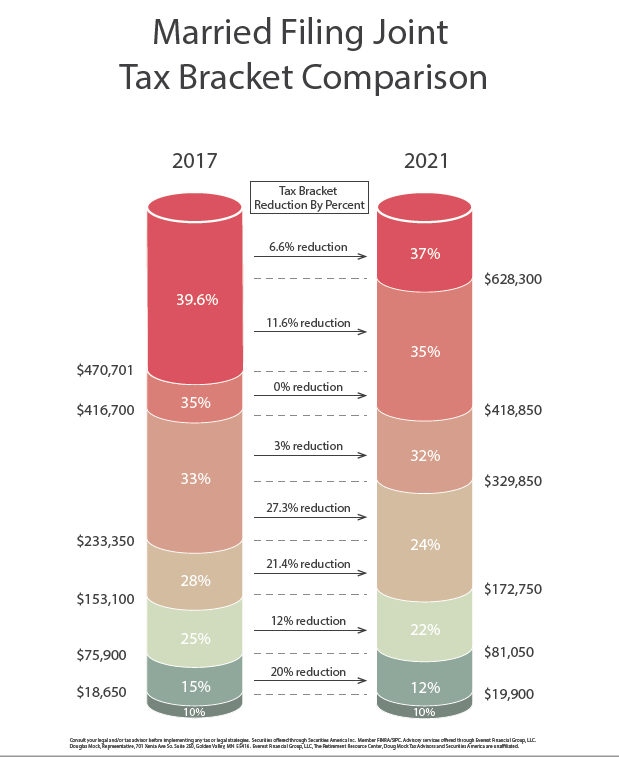

Itemized deductions allow taxpayers to deduct specific expenses from their taxable income. However, the Tax Cuts and Jobs Act of 2017 limited the availability of itemized deductions, including the deduction for state and local taxes. Therefore, most taxpayers find it more beneficial to claim the standard deduction rather than itemizing their deductions.

The child tax credit is a tax credit that reduces the amount of tax owed by families with children. The credit is available for each qualifying child under the age of 17. The amount of the child tax credit for 2025 and 2026 is $2,000 per qualifying child.

The earned income tax credit (EITC) is a tax credit for low- and moderate-income working individuals and families. The amount of the EITC depends on the taxpayer’s income, filing status, and number of qualifying children. The EITC is fully refundable, meaning that taxpayers can receive a refund even if they do not owe any taxes.

The 2025-2026 tax brackets and deductions have been adjusted for inflation. The income thresholds for each tax bracket have increased, and the standard deductions have also increased. These changes are intended to provide taxpayers with some relief from the effects of inflation.

The 2025-2026 tax brackets and deductions reflect the changes in the tax code and the effects of inflation. Taxpayers should be aware of these changes and how they will affect their tax liability. By understanding the tax brackets and deductions, taxpayers can make informed decisions about their financial planning and minimize their tax burden.

Thus, we hope this article has provided valuable insights into 2025-2026 Tax Brackets: A Comprehensive Overview. We hope you find this article informative and beneficial. See you in our next article!